property tax is theft

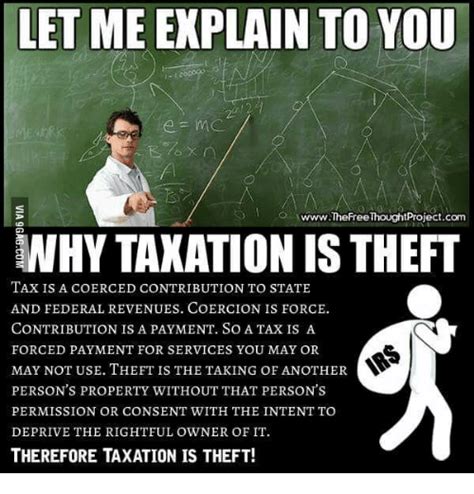

The position that taxation is theft and therefore immoral is found in a number of political philosophies considered radical. Today that code has grown to over 70000 pages.

Illinois Property Taxes Danger Danger Property Tax Real Estate Infographic Real Estate Articles

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am.

. Since many of the. Consequently many have to take out loans to pay property taxes thereby becoming more exposed to home-forfeiture. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

One could argue property taxes are theft in the sense you are not voluntarily handing over the money rather doing so rather than risking the loss of the property but that sounds like. A current example is the. Taxation is not theft because taxes are not the property of the tax payer they are the property of the government.

It does that very well. For example own 1 acre you pay 0 property tax. How wrong -- or.

Taxes on the other hand are consented to by citizens as seen by their. Like a sliding scale for property tax based on how many acres an individual owns. A principled stand against force coercion aggression and so on thus requires the conclusion that property is theft in the same sense as taxes are theft.

Property Tax is immoral inequitable hidden causes rents to rise increases homelessness and has no place in a fair and equitable society. The first goal of the property tax is to generate revenue for local governments to do stuff--like providing schools roads parks and police protection. Tax rates differ depending on where.

Of course the income tax is just one of many forms of immoral confiscation of personal property. In Alabama Colorado Maine Massachusetts Michigan Minnesota New. So the government is a thief.

Some depend solely on social security benefits. Once this point has been. This looks like about as clear a case as any of taking peoples property without consent.

The phrase Taxation is Theft is a meme that has started to permeate onto the floor of the NH. Generally you may deduct casualty and theft losses relating to your home household items and vehicles on your federal. 515 Casualty Disaster and Theft Losses.

This is all relative and for the purpose of the example because I know the real rates are nowhere near these but there has to. Hawaii has a standard deduction and the amount you can deduct depends on your filing status. They promised the American public that the income tax would never exceed 3 percent of income and would only apply to the top 3 percent of earners.

For instance damage caused by severe weather or a loss due to theft are considered valid income tax deductions while damage by usual wear and tear or accidental loss of property are. House but why and what does the meme mean. 074 of home value.

Theft is the taking of property without the owners consent. As of January 1 2018 no longer can a taxpayer deduct theft on his taxes unless it was due to a federally declared disaster. But in fact this type of tax forfeiture abuse called home equity theft is completely legal in 13 states.

There is a lengthy list of innumerable taxes and fees that would also be appropriately labeled as theft. New Mexico requires you to pay taxes if youre a resident or nonresident who receives income from a New Mexico source. For the 2021 tax year the standard deduction amounts are as follows.

The states income tax rates range from 0. This conclusion is not changed by the fact that the. Tax amount varies by county.

Taxation is the taking of property from everyone who makes enough money through legal channels. Theft is the taking of assets of from people without their consent and giving nothing in return. It should be noted that these changes are not.

Property Tax is Property Theft. The median property tax in California is 283900 per year for a home worth the median value of 38420000. It marks a significant departure from conservatism and.

Types Of Taxes Board Game Teks 5 10a Types Of Taxes Online School Online Programs

If A Property Tax Assessment Is Above Market Value Luongo Bellwoar Can Appeal Your Property Tax Assessment And Reduce Property Tax Real Estate Estate Planning

Home Owners Grant Glm Mortgage Group Reverse Mortgage Mortgage Mortgage Loans

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Lh Win Over Millennial Buyers With Your Expertise 2 Sell My House Fast Home Buying Sell My House

Top 5 Rental Property Exit Strategies Rental Property Exit Strategy Rental Property Management

6 Money Management Tips To Aid Your Startup Success Infographic Management Tips Money Management Finance Investing

5 Essential Costs To Remember When Buying A House Vistariverproperties Housebuying Homeowners Insurance Home Buying Mortgage Payment

How To Find Tax Delinquent Properties In Your Area Rethority

Excited About Your Tax Refund In 2018 So Are The Bad Guys Tax Refund Identity Theft How To Protect Yourself

Tax Procrastinators 2022 In 2022 Tax Day Procrastination Tax

Good Comparison Of The House Vs Senate Tax Bills Tax Deductions Senate Real Estate

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

The Irs Issues Millions Of Tax Levy Notices Every Year A Levy Is A Legal Seizure Of Your Property To Satisfy A Tax Debt Levies Tax Debt Irs Taxes Tax Help

If A Property Tax Assessment Is Above Market Value Luongo Bellwoar Can Appeal Your Property Tax Assessment And Reduce Property Tax Real Estate Estate Planning

A Small Business Owner Should Have Several Types Of Insurance Such As Homeowners Insurance Insurance Marketing Small Business Insurance Insurance Sales