jefferson parish property tax records

The Jefferson Parish Assessor is responsible for appraising real estate and assessing a property tax on properties located in Jefferson Parish Louisiana. For a tax research certificate for purposes of LA RS.

St Tammany Parish Sheriff 007 Sheriff Office Sheriff Parish

Jefferson Parish Assessors Office - Property Search.

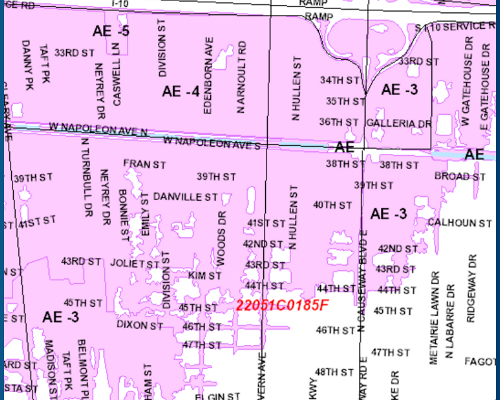

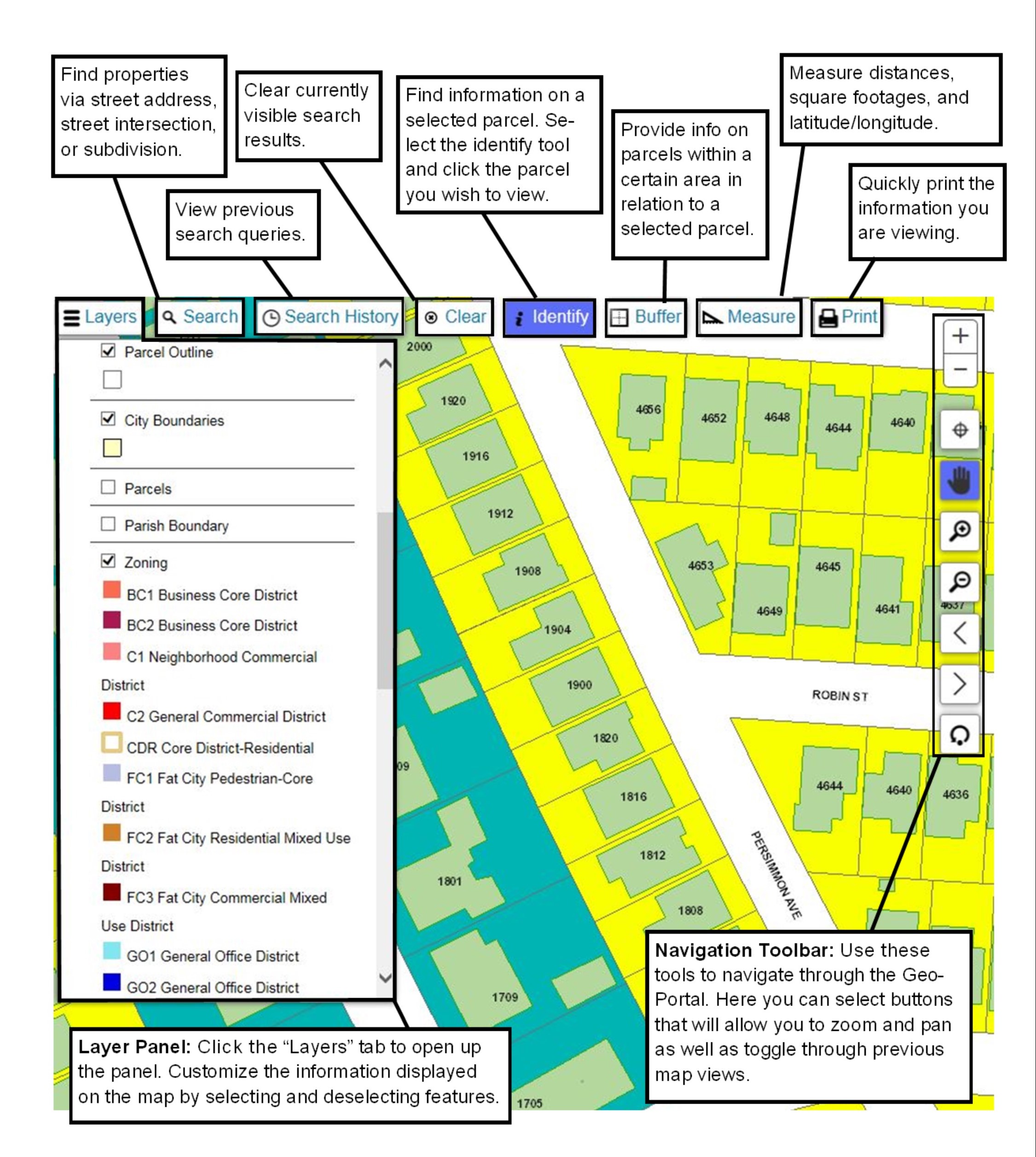

. Jefferson Parish has developed a Geographic Information Systems GIS database using aerial photography and field investigations. Jefferson Parish Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Jefferson Parish Louisiana. The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax.

Search Any Address 2. The office will reopen on Monday April 18 at 830 am. Jefferson Parish makes no warranty as to the reliability.

Welcome to the Jefferson Davis Parish Assessor Web Site. Homestead Exemption Deduction if applicable-7500. Assessed Value 20000.

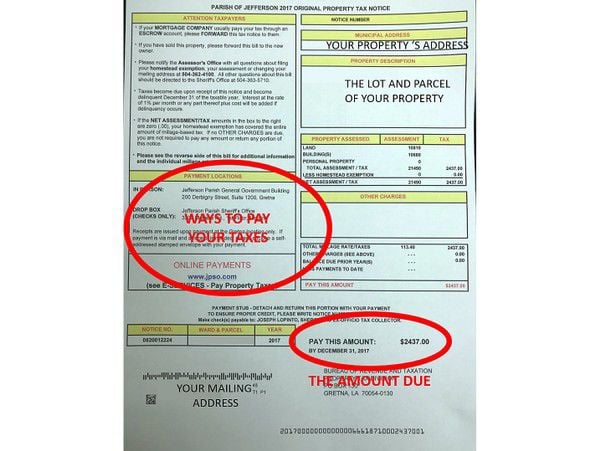

Search By Tax Year Payments are processed immediately but may not be reflected for up to 5 business days. Property tax bills may be remitted via mail hand-delivery or paid online at our website. Office of Motor Vehicles.

Property Tax Calculation Sample. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Government Building 200 Derbigny 4th Floor Suite 4200 Gretna LA 70053 Phone.

Jefferson Parish Code of Ordinances Section 2-151 requires the Parish. See Property Records Deeds Owner Info Much More. The assessment date is the first day of January of each.

Jefferson Parish LAT-5 forms are due 45 days after receipt. You can contact the Jefferson Parish. For Properties Located on the.

Parish Attorneys Office Code Collections 1221 Elmwood Park Blvd Suite 701 Jefferson LA 70123 Fax. Pay Property Taxes Online. Yearly median tax in Jefferson Parish.

Market Value 200000. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. If your homesteadmortgage company usually pays your property taxes please.

Get Property Records from 2 Code Enforcement. Jefferson Davis Parish Assessor Information and Property Search. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200.

Taxed Value 12500. The Jefferson Parish Assessors Office determines the taxable assessment of property. The Jefferson Parish Assessors Office will be closed on Thursday and Friday April 14 15 in observance of the Easter holiday.

3 rows Jefferson Parish Code Enforcement Offices. Get In-Depth Property Reports Info You May Not Find On Other Sites. When and how is my Personal Property assessed and calculated.

Free Jefferson Parish Assessor Office Property Records Search Find Jefferson Parish residential property tax assessment records tax assessment history land improvement values district. Jefferson Parish collects on.

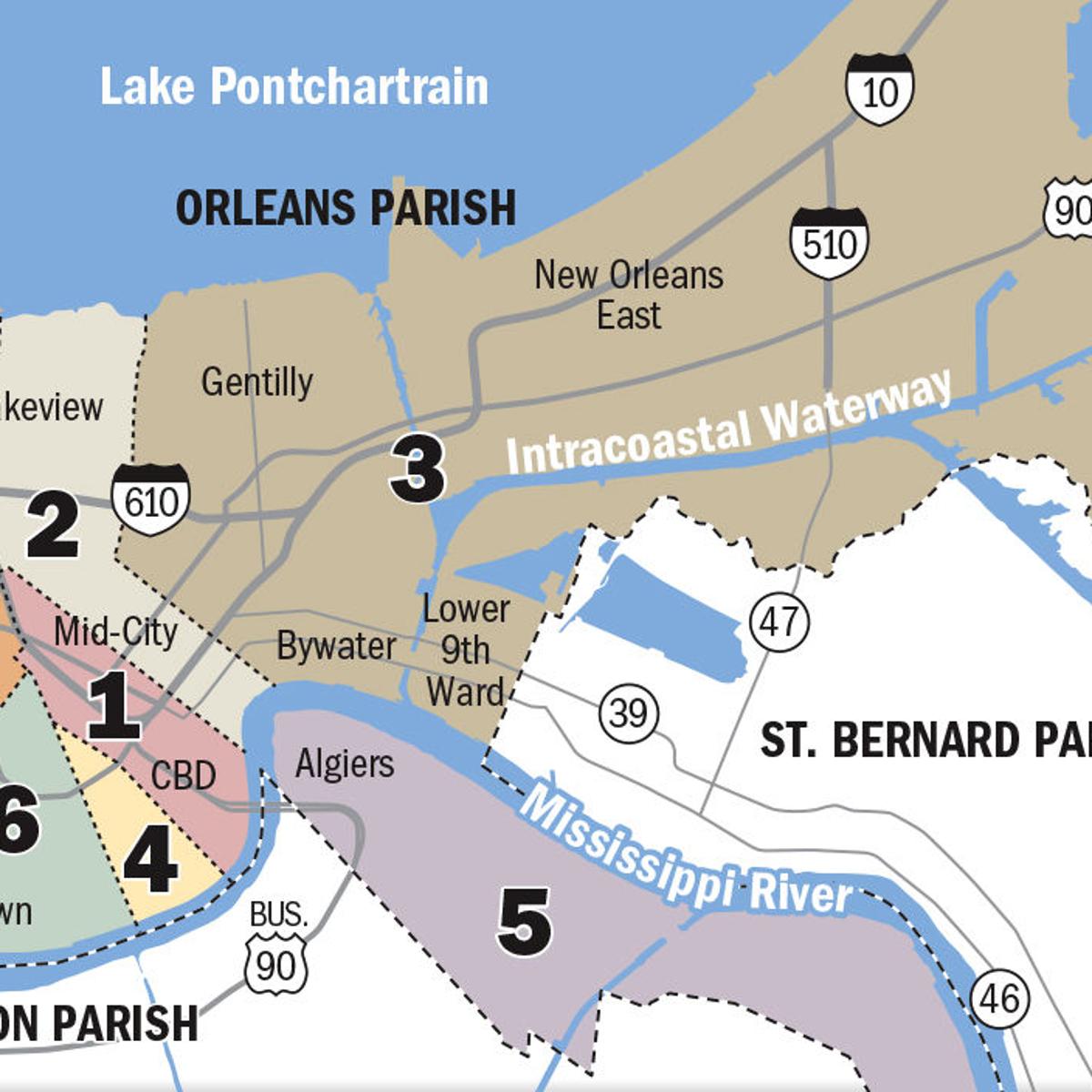

Orleans Parish Property Transfers June 22 26 2020 Business News Nola Com

Hurricane News And Information

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

E Services Jefferson Parish Sheriff La Official Website

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com